The financial planning industry is competitive. You’re not just competing with other local advisors—you’re also up against large firms, banks, and even online robo-advisors. Many of these companies have strong digital marketing strategies, making it harder for independent advisors to stand out.

If you’re a financial advisor, you know how important it is to gain the trust of potential clients. But before people can trust you, they need to find you. That’s where SEO for Financial Advisors and Financial Planning Services comes in.

Table of Contents

ToggleWhy SEO for Financial Advisors and Financial Planning Services

SEO helps your website appear on Google when people search for financial advice, giving you a steady stream of potential clients without relying only on referrals.

According to a study by BrightEdge, organic search drives 53% of all website traffic, making SEO a critical component for financial service providers. If your website isn’t optimized for search engines, you might be invisible to potential clients. Even if you’re the best advisor in town, people won’t find you if you’re buried on page two (or worse) of Google.

The good news? With the right SEO, you can increase your chances of showing up in search results and attracting more of the right clients.

How Potential Clients Search for Financial Advice Online

Gone are the days when people only relied on referrals to find a financial advisor. Now, they turn to Google with their questions. Here’s how they typically search:

Service-Based Searches

Many people search for a specific service, such as:

“Retirement planner near me”

“Financial advisor for small business owners”

“Best investment advisor in [city]”

If your website is optimized with these keywords, you have a better chance of appearing in their search results.

Problem-Based Searches

Some people don’t know exactly what service they need, but they search for solutions to their financial concerns:

“How to reduce taxes before retirement”

“Should I open an RRSP or TFSA?”

“How to create a budget for financial freedom”

You can get visitors who might become customers by writing blog posts or Frequently Asked Questions (FAQs) that answer these questions. A report by Google states that 81% of consumers conduct online research before making a major purchase or financial decision.

Local Searches

Many clients prefer working with a financial advisor in their area. They’ll search for terms like:

“Financial planner in [city]”

“Best financial advisor near me”

Optimizing your website for local SEO—such as adding your business to Google Business Profile and including your location on your website—helps you appear in these searches. Google’s research shows that 76% of people who conduct a local search visit a business within 24 hours.

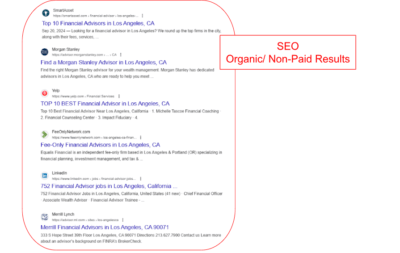

SEO vs Google Ads

SEO and Google Ads are both ways to get people to visit your website, but they work differently. SEO, which stands for Search Engine Optimization. You spend time creating helpful, trustworthy content on your website, making sure your pages load fast, are mobile-friendly, and use the right words people are searching for.

Over time, your website grows in Google’s “eyes,” and your pages show up higher in search results for free. Google Ads, on the other hand, is like paying for a billboard on a busy highway; you create ads and pay Google so your website appears at the top of search results right away. Ads give you fast results, but you stop getting traffic as soon as you stop paying, while SEO builds long-lasting visibility.

Both are useful: SEO helps you get people naturally interested in your services and trust your brand, and Google Ads is great if you need quick attention, like for a new promotion or urgent client sign-ups. Many businesses actually use both together, so they get immediate visitors from ads while slowly growing free, organic traffic through SEO.

Google Business Profile

A Google Business Profile is like your free online business card on Google. When people search for “financial advisor near me,” it shows your business name, address, phone number, website, hours, photos, and client reviews. For financial advisors, this builds trust and makes it easier for local clients to find you.

To get the best results, keep your info updated, add professional photos, and ask satisfied clients to leave reviews. This helps Google show your profile more often in local searches.

Competitive Offer

A competitive offer is when you create a deal, service, or package that stands out from what other financial advisors are offering, making clients choose you over the competition. For example, instead of just advertising “financial planning,” you could offer a free 30-minute consultation, a personalized retirement plan, or a bundle package that includes tax and investment advice together.

The goal is to highlight the extra value you provide that others don’t, whether it’s better pricing, more personal service, or unique expertise. A strong competitive offer not only attracts attention but also builds trust because potential clients see that you’re willing to go the extra mile to earn their business.

The Impact of Ranking on Google for Financial Keywords

Ranking high on Google matters—a lot. Studies show that most people don’t scroll past the first few results. If your website is on page two or three, it’s unlikely anyone will click on it.

Here’s why ranking higher makes a big difference:

More Website Traffic – The top search results get the most clicks. If you’re ranking on the first page, you’ll get more visitors to your website.

More Trust and Credibility – People tend to trust websites that appear at the top of search results. They assume Google ranks the best and most reliable options first.

More Qualified Leads – If you’re ranking for targeted keywords (like “fee-only financial planner” or “best financial advisor for doctors”), you’re attracting potential clients who are specifically looking for your services.

SEO is an essential tool for financial advisors looking to grow their business online. You can boost your visibility, establish credibility, and draw in more of the right clients without breaking the bank by knowing how potential clients search for financial advice and tailoring your website accordingly.

Struggling to get found online? Our SEO solutions help financial advisors rank higher and attract ideal clients.

Key SEO for Financial Advisors and Financial Planning Services Strategies

Keyword Research for Financial Advisors

Keyword research is one of the most important parts of SEO for financial advisors. It helps you understand what potential clients are searching for on Google so you can create content that attracts them to your website. Choosing the right keywords can improve your search rankings and bring in more qualified leads.

Identifying High-Value Keywords

Not all keywords are equal. Some keywords have high search volume, meaning lots of people are looking for them, while others are more niche. As a financial advisor, you want to target high-value keywords—those that show strong intent from potential clients.

Here are some examples:

Service-based keywords: These keywords help people find the financial services they need.

“Retirement planning near me”

“Fiduciary financial advisor”

“Wealth management for doctors”

“Best financial planner in [city]”

Problem-solving keywords: Many people search for financial advice before they even realize they need an advisor. Answering their questions can help you attract them to your site.

“How to save for retirement”

“Best tax strategies for high-income earners”

“How to invest in a TFSA vs RRSP”

Competitor keywords: Some people search for well-known financial firms before deciding who to hire. You can optimize for these keywords by creating comparison pages or highlighting what makes your services unique.

“Independent financial advisor vs. [Big Firm Name]”

“Fee-only financial planner vs commission-based”

By targeting these high-value keywords, you increase your chances of ranking higher on Google and attracting potential clients who are actively looking for your services.

Using Short-Tail Keywords to Target Niche Markets

Short-tail keywords are very simple search terms, usually just one to three words, like “financial advisor,” “retirement planning,” or “investment help.” They get searched a lot and can bring in tons of traffic, but they’re also very competitive because many businesses are trying to rank for them.

Using short-tail keywords is helpful because they describe your services in a broad way and can bring general awareness to your business. However, since the competition is tough, it’s smart to mix them with long-tail keywords (like “financial advisor for retirement planning in Los Angeles”) so you have a better chance of reaching the right clients.

Struggling With Putting Your Page Together?

Schedule A Free Strategy Session!

Using Long-Tail Keywords to Target Niche Markets

Long-tail keywords are longer, more specific search phrases that may have lower search volume but attract highly targeted clients. For example:

Instead of targeting “financial advisor,” you could use:

“Financial advisor for small business owners”

“Best retirement planner for teachers”

“How to create a tax-efficient investment portfolio”

Long-tail keywords help you reach people who have very specific financial needs. Since fewer advisors compete for these keywords, it’s easier to rank for them and attract the right clients.

Monthly Search Volume

Monthly search volume shows how many times a keyword is searched on Google each month. For example, if “financial advisor near me” has 5,000 monthly searches, that means people type it into Google about 5,000 times every month.

This helps you pick the best keywords, ones that enough people are searching for but aren’t too competitive.

Keyword Difficulty

Keyword difficulty measures how hard it is to rank for a specific keyword on Google. A keyword with high difficulty, like “financial advisor,” has lots of competition from big websites. Easier keywords, often longer ones like “retirement planning for teachers,” give smaller businesses a better chance to rank. This helps you focus on keywords where you can realistically get found.

Using Relevant Keywords

Using relevant keywords means choosing words and phrases that match what your ideal clients are actually searching for. For financial advisors, this could be terms like “retirement planning,” “tax strategies,” or “wealth management near me.”

Adding these naturally into your website content, titles, and blogs helps Google understand what your site is about and makes it easier for the right people to find you.

Choosing The Right Target Keywords

Choosing the right target keywords means picking the search terms that best match your services and the clients you want to reach. For financial advisors, this could be broad terms like “financial planning” or more specific ones like “retirement advisor in Los Angeles.”

The right keywords should have enough monthly searches, not be too competitive, and match your clients’ needs. This way, you attract people who are most likely to become real clients.

Tools to Help with Keyword Research

To find the best keywords for your financial advisory business, you can use SEO tools that analyze search trends, competition, and keyword difficulty. Here are some helpful options:

Google’s Auto Suggest

Google’s auto-suggested keywords are the phrases that pop up under the search bar when you start typing something into Google. For example, if you type “financial advisor,” you might see suggestions like “financial advisor near me,” “financial advisor fees,” or “financial advisor for retirement.”

These suggestions come from real searches people make, so they’re a great way to find keyword ideas that your potential clients are already looking for.

Google’s Related Searches

Google’s related searches are the extra keyword ideas you see at the bottom of a Google search results page. For example, if you search “financial advisor,” you might find related searches like “best financial advisor near me,” “financial advisor cost,” or “how to choose a financial planner.”

These are helpful because they show what else people are searching for around your main keyword, giving you more ideas to target in your content.

Google Keyword Planner

Google Keyword Planner is a free tool from Google that helps you find the best keywords for your business. It shows you useful data like how many people search for a keyword each month (monthly search volume), how competitive it is (keyword difficulty), and even suggests other related keywords you might not have thought of.

For financial advisors, this can help you discover terms like “retirement planning services” or “tax advisor near me,” so you can create content that matches what potential clients are searching for.

Ahrefs Free Keyword Generator

Ahrefs Free Keyword Generator is a powerful SEO tool that helps you find keywords, track rankings, and analyze your competitors’ keyword strategies.

The keyword “financial advisors near me” is a good keyword because it directly connects to local, high-intent customers who are ready to take action. Here’s why:

Strong Buyer Intent

When someone types “financial advisors near me,” they’re not casually browsing — they’re actively searching for a professional they can hire soon. This makes the keyword transactional, meaning it’s tied directly to revenue opportunities.

Local Relevance

Financial advising is a trust-based, relationship-driven service. Most clients want an advisor close to where they live or work, so Google prioritizes local businesses. Ranking for this keyword positions you right where potential clients are looking.

High Conversion Potential

Traffic from this keyword is more likely to book a consultation or meeting compared to broad terms like “what is a financial advisor.” The user already knows what they want; now they’re deciding who to hire.

Competitive Advantage in Local SEO

Optimizing for “financial advisors near me” helps you show up in:

-

Google Maps results

-

Local 3-Pack listings

-

Organic search results

This gives you multiple chances to capture leads before competitors.

The keyword “what does financial advisors do” is a bad keyword because it doesn’t align with the kind of traffic that actually converts into paying clients. Here’s why:

Low Buyer Intent

Someone searching “what does financial advisors do” is usually looking for information, not looking to hire. They may be a student, someone considering the career, or just curious about the profession. None of these groups are likely to book a consultation.

Educational, Not Transactional

This search falls into the informational category of search intent. People want definitions, job descriptions, or general knowledge. It doesn’t translate into leads for your financial advising business.

Attracts the Wrong Audience

Instead of potential clients, you’d attract people who may:

-

Be writing a paper for school.

-

Be exploring career options.

-

Be generally curious.

These visitors don’t need a financial advisor’s services they just want an explanation.

Poor ROI for SEO

Optimizing for this keyword takes time and resources but doesn’t result in meaningful conversions. You’d get traffic, but it would be low-quality traffic with no business value.

Semrush’s Free Keyword Tool

SEMrush – Another all-in-one SEO tool that provides keyword data, backlink analysis, and competitive research. Great for identifying high-value keywords.

Using these tools, you can discover the best keywords for your business and create content that helps you rank higher in search results.

A solid SEO strategy starts with keyword research. Targeting long-tail and high-value keywords will increase the number of potential clients that visit your website. And with the right tools, you can stay ahead of the competition and ensure your financial advisory services are easy to find online.

Want more leads for your financial services? Let’s optimize your website and boost your search rankings.

Get Your Free SEO Consultation Today!

Tracking Keyword Rankings

Tracking keyword rankings using Serprobot is a simple way to see how well your website is performing in Google search results for the keywords you care about most. When you choose certain keywords, like “financial advisor near me” or “retirement planning services,” Serprobot tracks your position every day and shows whether your rankings are going up, staying the same, or dropping.

This is very important for financial advisors because SEO is a long-term process, and rankings can often change depending on what competitors are doing or how Google updates its system.

By checking your rankings with Serprobot, you can quickly spot which keywords are bringing in results and which ones may need stronger content, more backlinks, or better optimization. Over time, this helps you focus your energy on the keywords that bring in the most potential clients, instead of guessing or wasting effort on terms that don’t matter as much.

Understanding Search Intent

Understanding search intent means figuring out why someone is typing a keyword into Google. It’s about knowing what the person really wants so you can give them the right answer.

Informational Intent

Informational intent is when someone searches on Google because they want to learn something, not necessarily buy or hire right away. For example, if a person types “how to start saving for retirement” or “what does a financial advisor do,” they’re looking for answers, tips, or explanations.

For financial advisors, this is a chance to create helpful blog posts, guides, or videos that answer these questions clearly. Even though these searchers may not be ready to become clients yet, providing valuable information builds trust and makes it more likely they’ll come back to you when they are ready to hire an advisor.

Navigational Intent

Navigational intent is when someone searches for a specific company, brand, or website because they already know where they want to go. For example, if someone types “Fidelity login” or “XYZ Financial Advisors website,” they’re not looking for general advice but for a particular business or page.

For financial advisors, this means clients might search directly for your firm’s name, like “Smith Financial Planning” or “John Doe CFP website.” Having strong SEO, a clear website, and a complete Google Business Profile makes sure people can find you quickly when they already know who they’re looking for.

Commercial Intent

Commercial intent is when someone is searching because they’re interested in buying soon, but still comparing options. They want to learn more about services, prices, or reviews before making a decision. For example, searches like “best financial advisor near me,” “financial advisor reviews,” or “fee-only financial planner vs commission-based” show commercial intent.

For financial advisors, this is the perfect time to stand out by having clear service pages, testimonials, case studies, and blog posts that answer comparisons or common questions. This helps build trust and convinces people that you’re the right choice when they’re close to hiring.

Transactional intent

Transactional intent is when someone is ready to take action right now, like hiring a financial advisor, booking a consultation, or signing up for a service. These searches usually sound very direct, such as “hire financial advisor near me,” “book retirement planning consultation,” or “financial advisor free consultation.”

For financial advisors, this is the most valuable type of intent because it means the person is ready to become a client. To capture these leads, your website should make it easy to act with clear call-to-action buttons (like “Schedule a Consultation”), simple contact forms, and visible phone numbers, all help turn those searches into real appointments.

Struggling With Setting Up Your Website To Have Good SEO? We Can Help!

On-Page Strategies on SEO for Financial Advisors and Financial Planning Services

Once you’ve identified the right keywords, the next step is to optimize your website so search engines (and potential clients) can easily find and understand your content. This is called on-page SEO, and it involves improving your service pages, blog content, and site structure to boost your rankings on Google.

URL Slugs

URL slugs are the short parts of a website link that come after the main domain name and point to a specific page. For example, in www.financepro.com/retirement-planning, the slug is retirement-planning.

Good slugs are short, easy to read, and include keywords that describe the page. For financial advisors, instead of a messy slug like /page?id=12345, a clean slug like /investment-advice or /tax-planning-services is better. Clear slugs help both Google and users understand what the page is about, which can improve rankings and make your site look more professional.

Alt Tags

Alt tags (also called alt text) are short descriptions added to images on your website. They tell Google and screen readers what the image is about since search engines can’t “see” pictures. For example, if you post a photo of a financial advisor meeting with a client, the alt tag could be “financial advisor explaining retirement plan to client.”

Using clear alt tags helps your site’s SEO by giving Google more context about your content, and it also makes your website more accessible for people who use screen readers. For financial advisors, adding keywords naturally into alt tags is a smart way to improve search visibility.

Title Tags for Financial Advisors

Title tags are a cornerstone of SEO because they serve as the clickable headline in Google search results. For financial advisors, optimizing title tags is crucial to attracting potential clients who are searching for help with retirement planning, investment strategies, wealth management, or financial consulting.

A well-written title tag should make it clear what service you provide and who you serve, while also including important keywords. For example, instead of a vague title like “Home Smith & Co.,” a stronger choice would be “Financial Advisor in Denver | Retirement & Investment Planning.”

This instantly communicates relevance to both search engines and prospective clients. Best practices include keeping your title tag under 60 characters, incorporating your main keyword naturally, and adding a location if you work with local clients. Including your firm’s name at the end can also help build brand recognition and credibility. By fine-tuning title tags for each service page, financial advisors can improve rankings and appeal directly to the people who need their expertise most.

Meta Descriptions for Financial Advisors

Meta descriptions, which appear under the title tag in search results, are just as important because they act as your website’s first sales pitch to potential clients. Although meta descriptions don’t directly influence rankings, they strongly affect click-through rates. For financial advisors, this is a chance to reassure prospects that you understand their financial needs and can provide personalized solutions.

A strong example might be: “Looking for a trusted financial advisor in Chicago? We specialize in retirement planning, wealth management, and investment strategies tailored to your goals.” This type of description gives searchers confidence while also encouraging them to take the next step. Best practices include keeping descriptions between 150–160 characters, incorporating keywords naturally so Google highlights them, and using action-oriented language like “schedule a consultation,” “plan your future today,” or “get expert financial advice.”

Highlighting unique benefits, such as fiduciary responsibility, years of experience, or customized strategies, also helps differentiate your practice. By crafting compelling meta descriptions, financial advisors can boost conversions and turn more searchers into long-term clients.

Creating Informative Blog Content

Blogging is one of the best ways to improve SEO and attract potential clients. When people search for financial advice, they often start with questions like:

“What are the best tax strategies for retirees?”

“How much should I save for retirement?”

“What is the difference between a fiduciary and a financial advisor?”

If your website has helpful blog posts answering these questions, Google is more likely to rank your site higher, and potential clients are more likely to find you.

Here’s how to create SEO-friendly blog content:

- Target long-tail keywords – Instead of writing a generic blog like “Retirement Planning Tips,” be more specific: “5 Smart Tax Strategies for Retirees in 2024.”

- Make your content easy to read – Use short paragraphs, bullet points, and clear headings.

- Include internal links – Link to your service pages or related blog posts to keep visitors on your site longer. Example: If you’re writing about retirement planning, link to your Retirement Planning Services page.

- Add FAQs – Google loves content that directly answers user questions. Adding a short FAQ section at the bottom of your blog can help you rank for voice searches.

Tip: Posting regularly (at least 1-2 times a month) keeps your website fresh and signals to Google that your content is up-to-date.

Work with SEO experts who care about results.

Using Internal Linking to Boost Site Navigation

Internal linking means adding links between different pages on your website. It helps search engines understand the structure of your site and encourages visitors to explore more pages.

Here’s how to do it effectively:

- Link to your service pages in your blog posts – If you write a blog about tax planning, add a link to your Tax Planning Services page.

- Create pillar content with supporting articles – For example, if you have a main page about Retirement Planning, you can create blog posts on related topics like 401(k) strategies, Social Security benefits, and estate planning, then link them all together.

- Use descriptive anchor text – Instead of writing “Click here,” use text that describes the page, like “Learn more about our financial planning services.”

Tip: Internal linking not only helps with SEO but also keeps visitors on your site longer, increasing the chances of them reaching out for a consultation.

Making your website easier for search engines and potential customers to find and navigate is the main goal of on-page SEO. You can get better rankings and more of the right clients by optimizing your service pages, writing helpful blog posts, and using internal linking.

Using External Linking

Using external linking means adding links from your website to other trustworthy websites. For example, if you’re writing about retirement planning, you might link to the IRS website for tax rules or an article from an official financial news site.

This shows Google that you’re providing reliable information and helps your visitors get more resources. For financial advisors, external links to trusted sources build credibility, improve user experience, and can even boost your SEO because Google sees you as part of a trustworthy network of information.

Importance of Google Business Profile Optimization

Your Google Business Profile (GBP) (formerly Google My Business) is one of the most powerful tools for local SEO. It helps your business appear in Google Maps and local search results when people look for financial advisors near them.

Here’s how to optimize it:

- Claim and verify your profile – If you haven’t done this yet, go to Google Business Profile and follow the steps to set up your listing.

- Use the right business category – Choose categories like Financial Planner, Investment Consultant, or Wealth Management Advisor to help Google match your business to relevant searches.

- Add your services and keywords – In your business description, include terms like “Retirement planning in [city]” or “Fee-only financial advisor near me.”

- Keep your information updated – Make sure your name, address, phone number, and website are accurate and match what’s on your website.

- Post regular updates – Google allows you to share posts, like blog updates, financial tips, or special offers. This keeps your profile active and engaging.

Tip: A well-optimized GBP listing can help you show up in the Google Map Pack, which appears above regular search results and gets more clicks.

Compressing Large Image Files

Compressing large image files means making image sizes smaller without losing too much quality. Big images can slow down your website, which hurts both user experience and SEO since Google favors fast-loading sites. By compressing images, your pages load quicker, clients don’t have to wait, and your site performs better on mobile devices.

For financial advisors, this is especially important because potential clients may leave a slow site and go to a competitor. Tools like TinyPNG, JPEG-Optimizer, or built-in website plugins can help you easily shrink file sizes while keeping your images looking professional.

Improving Readability Level

Improving readability level means making your website content easy for people to understand. If your text is too complex or filled with financial jargon, visitors may get confused and leave. Instead, use short sentences, simple words, and clear headings to explain ideas. For example, instead of saying “diversify your portfolio to mitigate risk exposure,” you could say “spread your investments to lower risk.”

For financial advisors, writing in a way that an 8th grader can follow is best it keeps readers engaged, builds trust, and makes your advice more approachable. Google also favors content that is easy to read, so improving readability helps both your audience and your SEO.

Local Keyword Targeting for Better Visibility

To rank higher in local searches, you need to use local keywords on your website and Google Business Profile. These keywords help Google understand where your business is located and who you serve.

Here are some examples of effective local keywords:

- “Financial planner in [city]”

- “Retirement advisor near me”

- “Best investment advisor in [your area]”

- “Wealth management services in [neighborhood]”

How to use them:

- On your website: Add local keywords to your homepage, service pages, and blog posts. Example: “Looking for a trusted financial advisor in Toronto? We specialize in retirement planning and wealth management.”

- In your GBP profile: Include them in your business description and service listings.

- In blog content: Write articles like “How to Choose the Best Financial Advisor in [City]” to attract local searches.

Tip: Adding location-based pages (e.g., “Financial Planning Services in Los Angeles”) can help you rank in multiple areas.

Getting Client Reviews to Build Trust and Improve Rankings

Reviews play a huge role in local SEO and client trust. Google ranks businesses with more positive reviews higher in search results. Plus, potential clients are more likely to contact an advisor with strong, authentic reviews.

Here’s how to get more reviews:

- Ask satisfied clients for reviews – After a successful consultation or service, politely ask clients to leave a review on your Google Business Profile.

- Make it easy – Send them a direct link to your Google review page. You can generate one using your GBP account.

- Respond to all reviews – Whether good or bad, replying to reviews shows you value client feedback. For example:

“Thank you for your kind words, John! We’re glad we could help with your retirement planning.”

“We appreciate your feedback, Sarah. If there’s anything we can do to improve, please let us know!”

- Encourage honest feedback – The more detailed and specific the review, the better. Reviews that mention your services (e.g., “helped me with retirement planning”) can improve your search rankings.

Tip: Reviews on third-party sites like Yelp, Facebook, and Trustpilot can also help boost your credibility.

Local SEO is essential for financial advisors who want to attract more clients in their area. You can improve your search rankings and build trust with potential clients by optimizing your Google Business Profile, using local keywords, and gathering client reviews, you can improve your search rankings and build trust with potential clients.

Grow your financial advisory business with targeted SEO strategies. More visibility = More clients!

Link Building and Off-Page SEO for Financial Advisors and Financial Planning Services

SEO isn’t just about optimizing your website; it’s also about building authority and trust across the web. That’s where off-page SEO comes in. Off-page SEO focuses on improving your site’s reputation by getting backlinks (links from other websites), which tell Google that your site is credible and valuable.

Here’s how you can build strong backlinks and boost your search rankings.

Earning Backlinks from Finance-Related Websites

Backlinks are like digital referrals. When a reputable website links to yours, it tells Google that your content is valuable. The more high-quality backlinks you have, the better your site’s chances of ranking higher.

Here’s how financial advisors can earn backlinks:

- Create high-quality content that others want to link to – Write blog posts, guides, or research-backed articles on topics like “Best Retirement Planning Strategies for 2024.”

- Get featured on financial news websites – Websites like Forbes, Investopedia, or NerdWallet often feature financial experts. You can pitch your insights or offer expert quotes.

- Collaborate with industry partners – If you work with accountants, lawyers, or real estate agents, ask them to link to your site from theirs (and you can return the favor).

- Get mentioned in “Best Financial Advisors” lists – Many websites create roundups of the best advisors in certain locations or specialties. Reach out to be included.

Tip: Not all backlinks are equal. Aim for links from authoritative finance websites rather than random, low-quality sites.

Content Marketing

Content marketing is all about creating and sharing valuable information to attract and build trust with potential clients. Instead of only advertising your services, you provide helpful content like blog posts, guides, videos, podcasts, or even social media tips that answer common financial questions.

For example, a financial advisor might write an article on “5 Simple Steps to Start Saving for Retirement” or make a short video explaining “How to Create a Monthly Budget.” This type of content shows your expertise, helps people solve problems, and keeps your business top-of-mind. Over time, content marketing not only brings more visitors to your website but also turns them into clients because they see you as a reliable and knowledgeable professional.

Social Media Marketing

Social media marketing is using platforms like Facebook, LinkedIn, Instagram, or even YouTube to share valuable content, connect with people, and promote your services. For financial advisors, this could mean posting short money tips, sharing blog articles, celebrating client success stories (with permission), or running ads to reach local audiences.

The goal is to build trust, show your expertise, and stay visible where your potential clients spend their time online. Social media also helps you interact directly with people, answering questions, joining conversations, and showing the human side of your business. When done consistently, it can drive more traffic to your website and help turn followers into clients.

Online Forums

Online forums are communities where people ask questions, share experiences, and look for advice on specific topics. For financial advisors, forums like Reddit’s personal finance threads, Quora, or specialized money-focused communities are great places to share your knowledge. By answering questions such as “How much should I save for retirement?” or “What’s the difference between a financial advisor and a financial planner?” you can show your expertise and build credibility.

The key is to be helpful and not overly salesy, and offer real value first. Over time, people who see your answers may visit your website, follow your content, or even reach out to become clients. This makes forums a smart way to build trust and attract new leads.

Guest Posting on Industry Blogs

Guest posting means writing articles for other blogs in your industry. This is a great way to showcase your expertise, reach new audiences, and earn valuable backlinks.

How to do it:

- Find finance-related blogs that accept guest posts – Look for websites in the financial planning space that publish guest content. You can search Google for:

“Write for us” + financial planning

“Guest post” + personal finance

- Pitch relevant topics – Choose topics that align with your expertise, such as “How to Create a Financial Plan for Early Retirement.”

- Include a link to your website – Most guest posts allow you to add a link to your website in your author bio or within the article.

Tip: When guest posting, focus on quality over quantity. One guest post on a high-authority website is worth more than multiple posts on low-quality sites.

Building Citations in Online Directories

Citations are mentions of your business name, address, and phone number (NAP) on online directories. They help with local SEO and increase your online credibility.

Where to list your financial advisory firm:

Google Business Profile – If you haven’t claimed your listing yet, do this first!

Finance-specific directories – Examples include XY Planning Network, NAPFA, and SmartAsset.

Local business directories – Listings on Yelp, Yellow Pages, and Chamber of Commerce websites help improve visibility.

LinkedIn and Facebook – These social platforms also act as citations when your business details are listed correctly.

Tip: Make sure your NAP information is consistent across all listings. If your phone number or address varies, Google might get confused and lower your rankings.

Building backlinks and improving off-page SEO takes time, but it’s one of the best ways to increase your website’s authority and Google rankings. You can improve your online visibility and get more customers by getting good backlinks, writing guest posts for financial blogs, and adding your business to directories.

Need help to optimize your website?

Technical SEO Essentials for Financial Advisors

Technical SEO might sound complicated, but it’s really about making sure your website is fast, secure, and easy for search engines to understand. A well-optimized site can rank higher on Google and provide a better experience for potential clients.

Here are the key technical SEO factors financial advisors should focus on:

Ensuring a Fast, Mobile-Friendly Website

Nobody likes a slow website—especially potential clients looking for financial advice. If your website takes too long to load, visitors might leave before even seeing your services.

Check your site speed: Use tools like Google PageSpeed Insights to see how fast your site loads.

Optimize images: Large images slow down websites. Compress them using tools like TinyPNG or ShortPixel.

Enable caching: Caching helps browsers load your site faster by storing some data for repeat visitors.

Use a fast hosting provider: A good hosting service ensures your website loads quickly, even during high traffic times.

Tip: More people search for financial advisors on their phones than on computers. Make sure your website is mobile-friendly by using a responsive design that adjusts to different screen sizes. You can test this with Google’s Mobile-Friendly Test.

Improving Site Security with HTTPS

Security is a must for financial advisors. Visitors want to know their information is safe, and Google also prioritizes secure websites in search rankings.

Make sure your site has HTTPS: HTTPS encrypts data between your website and your visitors, protecting sensitive information. If your site still uses HTTP, contact your web host to install an SSL certificate.

Check for security warnings: If browsers show a “Not Secure” warning when visiting your site, it’s time to update to HTTPS.

Keep your website updated: If you use platforms like WordPress, always update plugins and themes to prevent security vulnerabilities.

Tip: A secure website builds trust with potential clients. When people see the padlock symbol in the address bar, they know their information is safe.

Keyword Cannibalization

Keyword cannibalization happens when two or more pages on your website are targeting the same keyword. Instead of boosting your rankings, these pages end up competing against each other, which can confuse Google and lower your visibility. For example, if a financial advisor has two separate pages, both optimized for “retirement planning services,” Google might not know which one to rank higher, so both could perform poorly.

To fix this, you can combine similar content into one stronger page, adjust keywords so each page has a unique focus, or use internal links to show Google which page is most important. Avoiding keyword cannibalization helps your site rank higher and ensures each page has a clear purpose.

Fixing Broken Links

Fixing broken links means checking your website for links that don’t work anymore, like ones that lead to a “404 error” page. Broken links hurt user experience because visitors get frustrated when they can’t reach the information they expect, and they can also hurt your SEO since Google sees them as signs of a poorly maintained site.

For example, if a financial advisor’s blog links to an old tax resource page that no longer exists, that’s a broken link. To fix them, you can update the link to a new resource, redirect it to a similar page, or remove it completely. Regularly checking for and fixing broken links keeps your website professional, user-friendly, and search engine-friendly.

Improving user experience (UX)

Improving user experience (UX) means making your website easy, enjoyable, and helpful for visitors. If people land on your site but find it confusing, slow, or hard to navigate, they’ll likely leave, and Google notices that. For financial advisors, good UX means having a clean layout, fast-loading pages, clear menus, and easy-to-read content.

It also means making important actions simple, like booking a consultation or finding your contact info in just one click. Adding visuals, using simple language, and making your site mobile-friendly also boost the experience. When users enjoy being on your site, they stay longer, trust you more, and are more likely to become clients, all while helping your SEO.

Struggling to show up on Google? We’ll guide you step by step to higher rankings!

Schedule Your Free SEO Consultation!

Common SEO Mistakes To Avoid

Common SEO mistakes to avoid are the slip-ups that can hurt your rankings and make it harder for clients to find you online.

Keyword Stuffing And Over-Optimization

Keyword stuffing and over-optimization happen when you try too hard to use the same keyword over and over in your content, titles, or meta tags. For example, if a financial advisor writes, “Our financial advisor offers the best financial advisor services for anyone needing a financial advisor,” it sounds unnatural and spammy.

Google can actually penalize sites for this because it doesn’t provide a good experience for readers. Instead, you should use keywords naturally, mix in related phrases (like retirement planning, investment help, wealth management), and focus on writing content that flows well. The goal is to help readers, not just to rank. When your content is clear and useful, both Google and your audience will reward you.

Neglecting Mobile Optimization

Neglecting mobile optimization means not making your website easy to use on phones and tablets. Since most people search on mobile, a site that loads slowly, has tiny text, or is hard to navigate will push visitors away, and Google may rank it lower. A mobile-friendly, fast site keeps potential clients engaged.

Ignoring User Experience

Ignoring user experience happens when your website is confusing, cluttered, or hard to use. If visitors can’t quickly find your contact info, understand your services, or navigate your pages, they’ll leave. A clean design, clear calls to action, and easy navigation make people trust you more and stay longer.

Need Help With Your Off-Page SEO?

Schedule Your Free SEO Consultation!

Final Thoughts on SEO for Financial Advisors and Financial Planning Services

As a financial advisor, implementing effective SEO strategies is one of the best ways to grow your business and attract more ideal clients. By focusing on key tactics, such as optimizing your website, creating valuable content, and leveraging local SEO, you can boost your online presence and build trust with potential clients.

Remember, SEO is a long-term strategy. It takes time to see results, but once you start optimizing your website and producing valuable content, you’ll begin to see your rankings improve and more potential clients find you online. The beauty of SEO is that it’s sustainable, and once your website starts ranking for your target keywords, the traffic you get will continue to grow over time.

By consistently focusing on SEO, you’re setting your business up for long-term growth and establishing yourself as a trusted financial advisor in your community.

If this all sounds a bit overwhelming, don’t worry—you don’t have to do it alone! If you’re short on time or want expert help, consider seeking professional SEO services. An experienced SEO professional can help you:

- Conduct thorough keyword research

- Optimize your website and content for the best results

- Monitor and adjust your SEO strategies regularly

Tip: Hiring an expert can save you time and help you avoid costly mistakes while maximizing your SEO potential. Schedule a free consultation with YoYoFuMedia now!

Interested in how Google Ads for Financial Advisors can help your business? Click here!